Featured Articles

Premia Post Newsletter

-1.jpg?width=1600&height=900&name=Untitled%20design%20(1)-1.jpg)

Housing Market Forecast: 4 Expert Predictions for 2024

By: Leslie Cook, Money Published: Jan 03, 2024

Here’s a piece of good news for rate-weary buyers: Relief is on the way. After months of turmoil, the housing market should be slightly calmer in 2024.

Although the factors that tanked affordability in 2023 — mainly high mortgage rates and lack of inventory — will still be at play in 2024, no one expects conditions to get any worse for buyers and sellers. In fact, many housing experts believe the new year will be a turning point for real estate: They say home sales should (somewhat) rebound, mortgage rates and prices should move lower, and more sellers will list their homes.

To be sure, these improvements will be gradual, and “housing affordability is still going to be the No. 1 issue for homebuyers,” says Danielle Hale, chief economist at Realtor.com. But slightly lower mortgage rates and prices will help lower the costs of homeownership.

What else can we expect from the 2024 housing market? Here’s what experts predict will happen with mortgage rates, inventory, home prices and sales in the near future.

Inventory will increase

Last year, sellers were loath to list their homes because they didn’t want to give up the low mortgage rates they’d previously locked in. As a result, there weren’t a lot of homes to choose from in 2023.

Thankfully, buyers can expect to see some improvement in the number of homes up for sale in 2024. Overall, inventory could increase by as much as 30% compared to last year, according to Lawrence Yun, chief economist at NAR, with some markets seeing even faster growth.

Skylar Olsen, chief economist at Zillow, says she has noticed in recent research that some homeowners who bought when rates were in the 5% and 6% range have readjusted their expectations around how low rates will go. They “are much less sensitive” to the rate-lock effect, Olsen says, adding that the rate homeowners consider “low enough” to prompt them to sell is increasing.

Home prices will likely stay flat

While there should be some improvement in housing supply and mortgage rates, the dynamics that have kept home prices high will continue.

Inventory is still well below demand. Before the pandemic, the number of active listings on the market averaged over 1 million homes, according to the St. Louis Fed. At the end of November, there were 754,846.

What does this mean for the market? Buyers are competing for fewer available homes, keeping upward pressure on home prices. So, on a national level, prices aren’t going to plummet unless we get a sudden and large influx of listings. Most experts forecast home prices will remain flat or decrease by about 1% in 2024.

That doesn’t mean there won’t be some markets where home prices majorly decline. There are currently a handful of cities where prices have decreased significantly, such as San Francisco and Las Vegas, and there’s a probability more cities will see considerably lower prices — just not on a level that could jeopardize the housing market as a whole.

Home sales will increase

Most housing analysts expect sales to improve this year thanks to improving overall market conditions. But not everyone agrees just how much better it will be.

The most conservative estimate for home sales comes from Realtor.com, which forecasts existing home sales to increase by 0.1% year-over-year, or a jump of about 4 million homes sold. At the opposite end of the spectrum is NAR, which is forecasting sales to increase by 13.5% compared to 2023.

It all goes back to — you guessed it — the hope that mortgage rates will continue to edge lower, which Yun says “will bring out more buyers and may even nudge some sellers to list their homes.”

Mortgage Rates Forecast For 2024: When Will Rates Finally Come Down?

By: Robin Rothstein, Forbes Advisor Updated: Jan 9, 2024

It seems mortgage rates fever has finally broken—at least for now.

After rising to a scorching 7.79% in October—the 2023 high—mortgage rates have cooled markedly in recent weeks amid signs of receding inflation pressures and promising signals from the Federal Reserve.

Following eight consecutive weeks of declines, the average 30-year fixed mortgage rate rose one basis point to 6.62% for the week ending January 4, according to Freddie Mac. A basis point is one-hundredth of one percentage point.

Nonetheless, while this promising downward rate trend bodes well for a stalled housing market, experts acknowledge that still-high rates and home prices will continue to create challenging conditions for many buyers and sellers in 2024.

Fed Holds Rates Steady for a Third Straight Time: What This Means for 2024 Mortgage Rates

In a widely anticipated move, the Federal Open Market Committee (FOMC) voted to leave the benchmark federal funds rate unchanged after its final meeting of 2023. The federal funds rate is the overnight borrowing rate for commercial banks and credit unions and indirectly influences mortgage rates.

This is the third consecutive FOMC meeting that resulted in a rate-hike pause, keeping the benchmark interest rate range between 5.25% and 5.5%.

Though Fed Chairman Jerome Powell reiterated at a post-meeting press conference that inflation is still well above the Fed’s long-term, sustainable 2% target rate, policymakers released updated economic projections with a lower rate range in 2024 that included three cuts by year’s end, implying rate hikes are over for this cycle.

So, what does all this mean for mortgage rates in 2024?

“Mortgage rates will continue to ease in 2024 as inflation improves and Fed rate cuts get closer,” said Danielle Hale, chief economist at Realtor.com, in an emailed statement. “Mortgage rates could near 6.5% by the end of the year, a key factor in starting to provide affordability relief to homebuyers.”

Over the past year and a half, mortgage rates have skyrocketed to their highest levels in decades amid the Fed’s aggressive interest rate policy actions to tame inflation. Recently, however, rates have declined steadily as a result of the Fed’s rate-hike pauses and cooling economic data.

Refinance activity, sluggish over the past year, is also starting to show signs of life amid declining mortgage rates, according to recent Mortgage Bankers Association data.

Experts believe that once the Fed cuts rates in 2024, refinance volume will increase even more as borrowers who took on high mortgage rates will jump at the chance to lower their monthly costs.

“If [mortgage] interest rates dropped to even 5.5%, it could result in significant savings for these homeowners, as refinancing at that rate could result in an average monthly payment of $1,917 for them, a reduction of $284 every month,” said Michele Raneri, vice president of U.S. research and consulting at TransUnion, in an emailed statement.

The FOMC meets next on January 30-31 for the first of its eight 2024 meetings.

Mortgage Rate Predictions for 2024

Here is how some experts predict market conditions will affect the average 30-year, fixed-rate mortgage in 2024:

- National Association of Realtors chief economist Lawrence Yun. “Mortgage rates look to head towards 7% in a few months and into the 6% range by the spring of 2024.”

- RSM U.S. real estate senior analyst Crystal Sunbury. “Assuming no significant economic shocks, mortgage rates are likely to continue slowly easing over the next few months, to reach a 6% to 6.5% range by spring of 2024.”

- Mortgage Bankers Association (MBA). MBA’s baseline forecast is for mortgage rates to end 2024 at 6.1% and reach 5.5% at the end of 2025 as Treasury rates decline and the spread narrows.

- Bank of America head of retail lending Matt Vernon. “The Fed’s likely decision to cut rates in 2024 would be a key factor that could breathe new life into the housing market. However, it’s important to note that significant drops in mortgage rates might not happen in the early months of 2024. If any reductions occur, they are likely to be gradual, possibly beginning in the latter part of the year.”

- Palisades Group chief investment officer and co-founder Jack Macdowell. “Our best guess is that mortgage rates will remain in the 7% to 7.25% range throughout Q1 2024.”

- Fannie Mae Housing Forecast. The 30-year fixed rate mortgage will average 7% in Q1 2024 and slowly decline over the year, landing at a Q4 average of 6.5%.

Is 2024 a Good Time To Refinance?

“Deciding whether 2024 is a good time to refinance depends on a few factors, with interest rates playing a crucial role,” says Bank of America’s Vernon.

Over 40% of U.S. mortgages originated in 2020 and 2021 when interest rates were at record lows. There were also some 14 million mortgage refinances during the same time. If you were lucky enough to secure a mortgage during that time, then 2024 is likely not the ideal time to refinance.

With rates still higher than a year ago, purchase and refinance applications remain stuck near their lowest level since the early 2000s, according to MBA data.

So now that 2023 is practically in the rearview mirror, should you be ready to refinance in 2024?

“If rates are lower than when you first got your mortgage, it might be a favorable time,” says Vernon. However, whether rates go lower in 2024 will depend, in part, on economic conditions.

“In times of uncertainty, rates typically remain low or may even decrease, whereas a thriving economy might result in higher rates,” says Vernon.

Even so, if you’re considering refinancing as a way to lower your monthly payment, keep in mind that not all options yield less interest over the life of the loan.

“Remember that just because you can get a lower rate, doesn’t mean you should immediately refinance,” says Vernon. “You may be paying a lower monthly mortgage, but you may have to also extend the life of your loan and refinancing could cost you more in interest.”

Current Mortgage Rates for January 2024

The average mortgage rate for a 30-year fixed is 7.12%, more than double its 3.22% level in early 2022.

The average cost of a 15-year, fixed-rate mortgage has also surged to 6.55%, compared to 2.43% in January 2022.

In the current environment, ARMs might be more affordable than those with fixed rates. The latest average for a 5/1 ARM was 6.04%.

What Do Current Rates Mean for Refinancing in 2024?

Refinance activity is showing some signs of life amid declining mortgage rates.

Yet, despite this relative surge, refinance volume sits at historically low levels. Here’s how refinance activity has trended recently, according to the MBA’s Weekly Mortgage Applications Survey.

Though mortgage rates have fallen recently, the average 30-year fixed rate remains roughly a quarter percent higher than a year ago, and refinance rates tend to be higher than purchase rates.

Meanwhile, many borrowers are sitting on the historically low mortgage rates they nabbed during the pandemic. Those rock-bottom rates are unlikely to return anytime soon—if at all—resulting in limited motivation for many homeowners to refinance.

Even so, experts believe the long stretch of abysmal refinance activity could finally be over.

“The overall level of refinance applications is still very low, but recent increases could signal that 2023 was the low point in this cycle for refinance activity, consistent with our originations forecast,” said Joel Kan, vice president and deputy chief economist at MBA, in a press statement.

With the Fed skipping rate hikes across three consecutive meetings and hinting at rate cuts in 2024, refinance activity may gain steam fueled by borrowers who purchased homes when rates were hovering near 8%.

The MBA predicts a 56% jump in refinance volume in 2024.

Pro Tip

Refinancing your mortgage is often a great financial move if you can qualify for a rate lower than your current rate and shorten your loan term. However, make sure you’ll remain in your home long enough to recoup the closing costs.

How To Get a Lower Mortgage Refinance Rate

The good news is that, despite elevated rates, there are methods you can employ to secure a lower rate. These methods might be especially beneficial if you bought a home between mid-October and early November 2022 when rates were at their pinnacle.

Because there are closing costs and fees associated with refinancing, many mortgage experts say refinancing only makes sense if you can snag a rate that’s at least 1% lower than your current rate.

Mortgage Rate Predictions for the Next 5 Years

While predicting mortgage rates for the next five years is a tall order, especially considering the unprecedented fluctuations over the past year, experts say the low housing inventory will be a key factor in where rates go over the long term.

“When rates come down, we’re going to be in store for another hot housing market where there are more buyers than sellers jacking up prices because we haven’t solved the problem” of low inventory, says Daryl Fairweather, chief economist at Redfin. “It’s still that affordability problem. That’s going to stay with us.”

As far as which direction interest rates go in the years ahead, Fairweather expects declines. However, the timeline for this downward trend remains uncertain.

“In every scenario, rates are going to come back down,” she says. “It’s just a matter of when.”

That “when” for Melissa Cohn, regional vice president at William Raveis Mortgage, won’t be in 2023—but she doesn’t see it as too far off.

“Mortgage rates will decline over the course of the next two to three years as the rate of inflation declines and hopefully gets to the Fed target of 2%,” Cohn says. “Mortgage rates will be at least a full 2% lower by 2025.”

She adds that if the inflation rate holds at 2%, then we should see mortgage rates remain at lower levels for the balance of the next five years.

What Affects Mortgage Rates?

A complex set of factors impact mortgage interest rates, including broader economic conditions, the monetary actions of the Federal Reserve (to some extent), and inflation. However, long-term mortgage rates are directly impacted by the bond market. The rate you’re offered on a mortgage will also depend on the lender you work with, its business costs, and your financial profile.

Demand for mortgages can also affect rates, pushing them higher as available capital for lending tightens. Conversely, when there’s less borrower demand—as we’re seeing now due to average interest rates hovering in the high 6% to low 7% range—lenders might consider offering more competitive rates or other incentives to attract borrowers.

How To Shop For the Best Mortgage Rate

Getting an optimal rate on a home loan can save you a significant amount of money over time. Here are some tips that can help you get the best rate possible for your situation:

- Keep your eye on rates. Mortgage rates are constantly changing. Keeping a close watch will make it easier to find and lock in a better rate.

- Check your credit. When you apply for a mortgage, the lender will review your credit to determine your creditworthiness as well as your interest rate. In general, the higher your credit score, the better your rate will be. To get an idea of where you stand, check your credit before you apply and dispute any errors with the appropriate credit bureau to potentially boost your score.

- Shop around and compare lenders. Consider options from as many mortgage lenders as possible to find the best deal for you. Prospective buyers have saved more than $1,500 over a loan’s term by getting two quotes from lenders and saved roughly $3,000 when they sought five quotes, according to Freddie Mac.

The Future of Work: Insights for 2024 and Beyond

By Kellie Hanna, CPRW, Career Advice Expert Last Updated: January 02, 2024

What’s in store for workers and the labor market for 2024? Between October 18–19, 2024, MyPerfectResume surveyed nearly 1,900 U.S.-based workers and asked them to share their forecasts and trends for 2024. The study provided valuable insights into job opening trends, job burnout, and the future of remote work. Moreover, if you harbor concerns about a potential 2024 recession or job displacement due to AI, rest assured we’ve got insights to share. Without further ado, here’s what our 2024 Workplace Trends Survey revealed!

Prepare for bad: recession, competition, and job cuts

MyPerfectResume’s extensive findings unequivocally mirror the prevailing negative sentiment emanating from job seekers as we stand on the cusp of 2024. Their concerns relate to various aspects of the labor market.

These expectations are the cautious outlook held by many individuals, highlighting their concerns regarding the stability and overall health of the country’s economy. Click here to

However, it’s essential to recognize that economic forecasts are influenced by a multitude of factors. While the concerns of those surveyed are valid, they also present an opportunity for resilience and adaptability.

Hardly optimistic news for job seekers here: 61% expect recruitment processes to be longer in 2024.

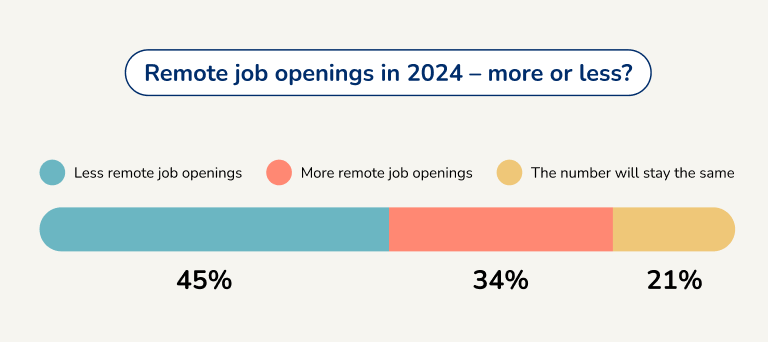

Our respondents were also asked about their thoughts on work models, especially remote work. Nearly half (45%) predict a reduction in remote job openings.

Staying with the subject of work models, almost 9 in 10 people (87%) believe more companies will introduce return-to-office (RTO) policies in 2024 than in 2024.

Consider this a positive trend. The resurgence of office work doesn’t confine you to the cubicle but paves the way for a powerful blend of in-office collaboration and home-based productivity.

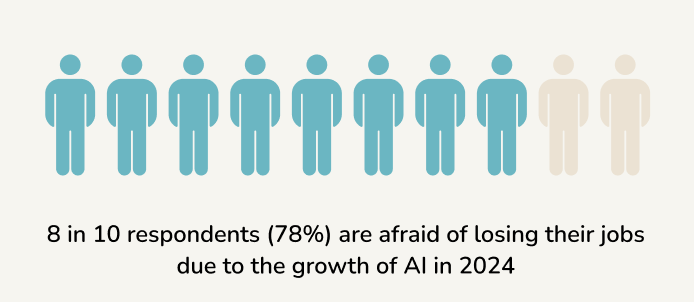

Still, more than returning to offices, people fear AI and new technologies.

8 in 10 respondents (78%) fear losing their jobs due to the growth of AI in 2024.

Are these concerns justified? At this point, most technologies need humans to operate effectively, so expect close cooperation.

Mind your mind

2024 does not promise to be a haven of peace.

62% expect the labor market will be more stressful than in previous years.

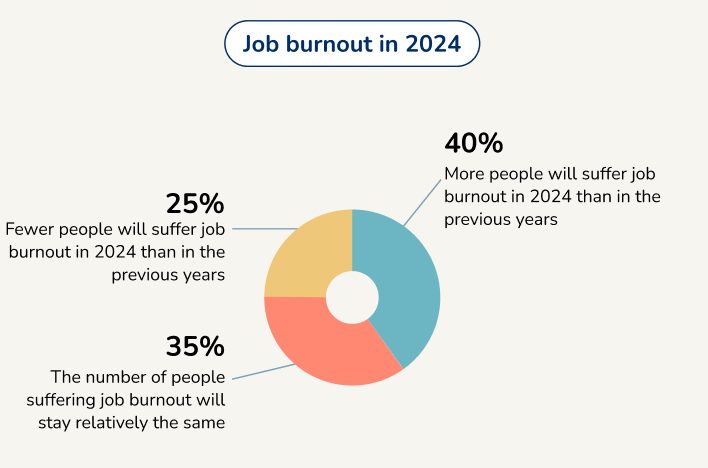

Additionally, 40% predict more people will suffer job burnout in 2024. Besides that, 35% say that the number of people suffering job burnout will stay relatively the same, while 25% hope that fewer workers will suffer job burnout.

These statistics indicate the challenges and demands that workers expect to face, highlighting the growing awareness of the well-being challenges.

In an evolving and demanding work environment, these findings underscore the critical need for individuals to be more mindful of their physical and mental health, ultimately fostering a more sustainable and balanced approach to work and life.

At the same time, these stats urge employers to implement strategies that promote employee wellness and prevent burnout.

Expect good: gig economy, salaries, and demand for workers

There’s also something good to come with 2024.

This trend suggests that more workers are embracing alternative work arrangements, seeking more flexibility, and exploring the gig economy’s opportunities. It also signifies a growing acceptance of non-traditional employment structures.

And it’s not only the gig economy that will thrive.

This promises that organizations will increasingly value expertise and niche skills, which aligns with the growing complexity of various industries and the evolving needs of the global economy. Workers, please don’t forget the importance of ongoing education and professional development.

Money speaks

The financial situation of employees also promises to be not too bad.

At the same time, 68% say employers must pay more to retain workers in 2024.

These insights lead to several conclusions. First, it’s evident that salary considerations remain a critical factor in job satisfaction and retention. Employers who fail to offer competitive salaries may risk losing valuable talent to competitors willing to pay more.

Second, the data highlights the potential for increased negotiation power among workers in 2024. As more employees seek higher salaries, job candidates and current employees may feel emboldened to request better compensation packages.

As 2024 approaches, prepare for bad and expect good.

%20(1)-1.webp?width=774&height=231&name=jpeg-optimizer_Premia%20Logo_White%20(1)%20(1)-1.webp)